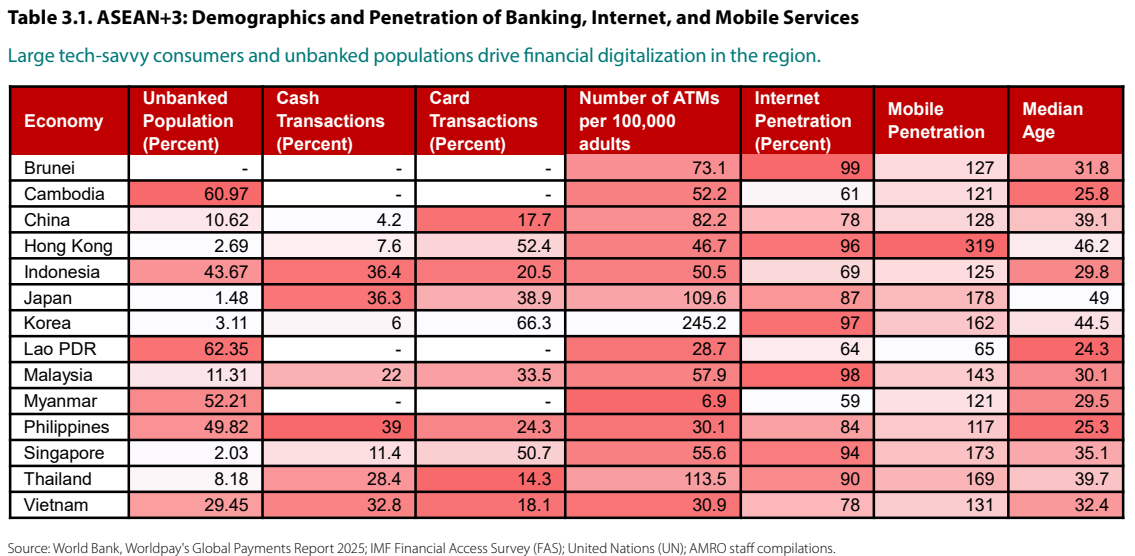

While the rapid evolution in Asia’s digital finance landscape significantly contributes to the region’s economic growth – driven by young, tech-savvy demographics and abundant investment fintech companies – challenges come with it, namely cyber security concerns, which necessitate a consistent regulatory response to build resilience and connections in a diverse region, according to a recent report.

In the Association of Southeast Asian Nations ( Asean ) region, with its particularly large population of young people, the digitalization of finance process has been predominantly driven by their growing demand for digital-first services, and this has smoothed the financial inclusion agenda, whereas in China, Japan and Korea the process has been driven by a quest to enhance efficiency, finds the latest Asean+3 Macroeconomic Research Office ( Amro ) report.

The digital agenda is also being expedited by innovations in areas like payments, alternative lending and insurance by private sector players, namely banks and fintech companies – in addition to government initiatives,

As well, Asian fintech companies, riding on stable investments, are some of the most profitable companies in the region and, according to the Amro report, are projected to have annual revenue growth of 36% until 2030.

As a result of the combined efforts of the private and public sectors, the region’s financial system is responding faster to disruptions and building stronger resilience.

The emergence of digital banks is also maturing the financial ecosystem and driving the integration of both financial and non-financial services.

“The changes have offered a wide range of benefits to consumers and financial institutions, the report notes, “but they also pose some financial stability challenges.”

Challenges

Digital banks, despite their high cash buffers, spark worries with their rapid expansion, which can increase digital banks’ exposures in risky lending sectors while lowering their liquidity ratios.

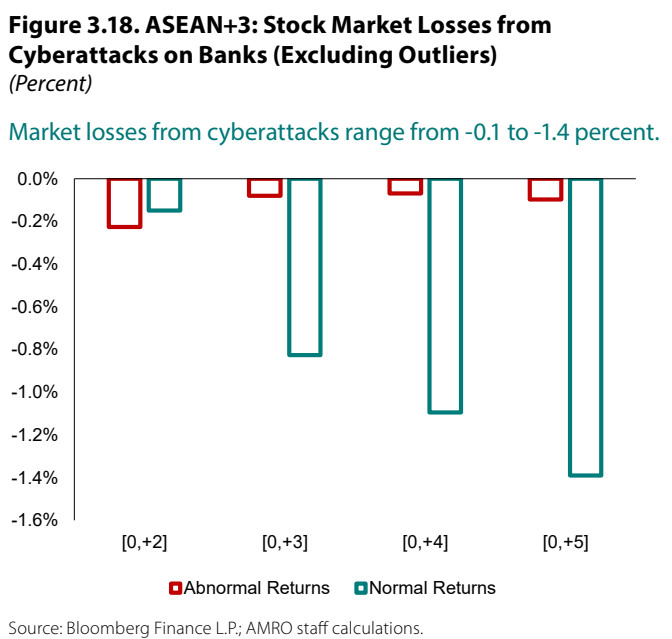

And amid quickening digitalization, cyber security is increasingly becoming an issue. Not only does cyber security lead to privacy concerns, it also damages reputation and has a knock-on effect on related market performance. Stock markets of the surveyed countries, the Amro report points out, recorded mild loss between 0.4% to 1.2% following a cyber attack in the region.

This surge of frauds, the credit risks of underbanked population and overreliance on technology stand in the way of a healthy digitalization process.

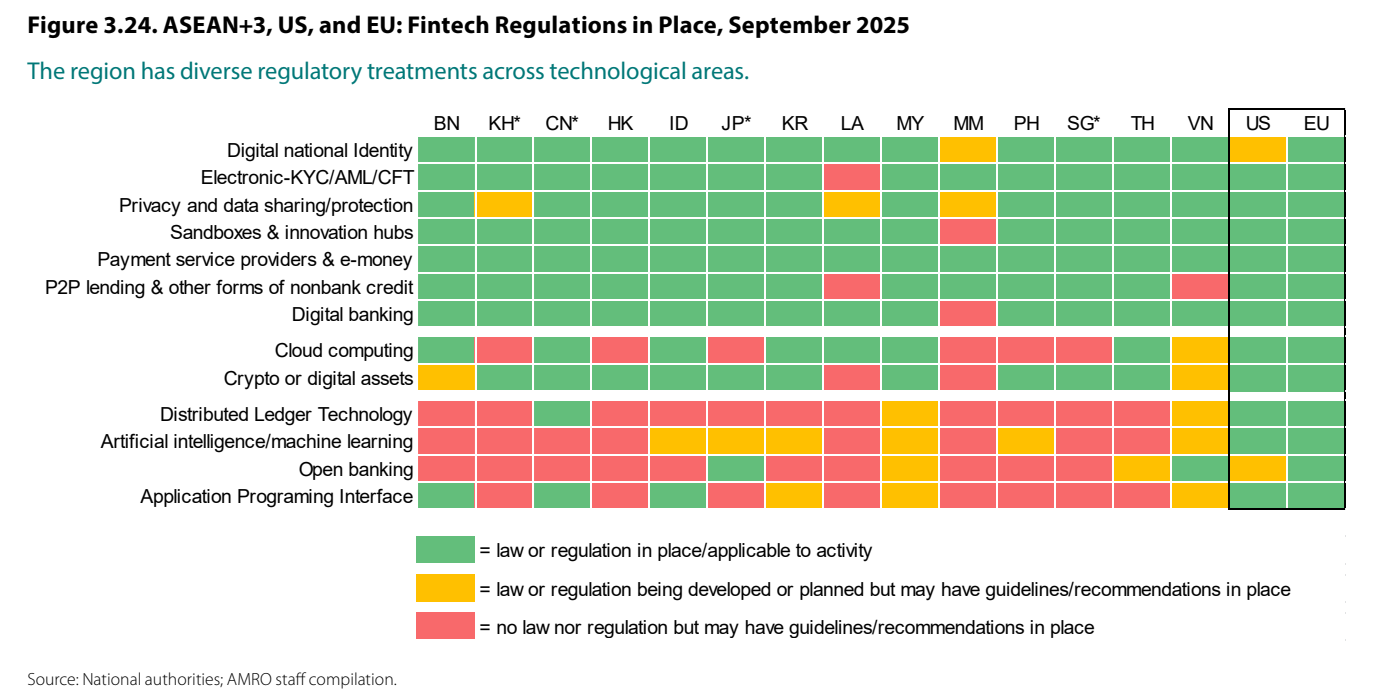

As such, regulators are advised, according to the report, to strengthen laws to provide a full-fledged guidance of practice, as emerging areas, including artificial intelligence and distributed ledger technology, currently lack oversight.

A holistic approach that includes revenue diversity, stable funding sources and risk management revision, the report suggests, is necessary to mitigate the negative impacts brought about by digitalization.

“With coordinated actions and deeper financial cooperation and integration,” says Dong He, Amro’s chief economist, “Asean+3 can turn today’s challenges into tomorrow’s opportunities and emerge stronger, more connected and more resilient.”