The global private credit market is set to sustain strong expansion in 2026, with a structural shift underway from traditional corporate direct lending towards asset-backed finance ( ABF ), according to a recent report.

One of the most powerful forces behind this shift is the surge in financing for digital infrastructure and the fact that Asia-Pacific private credit is becoming the next growth frontier as investors seek new channels for diversification and higher returns beyond mature Western markets, finds the report by rating agency Moody’s Ratings.

Rising global funding needs, alongside an active merger and acquisition and leveraged buyout environment will continue to lift assets under management ( AUM ) across private credit strategies.

And, while corporate lending still constitutes the majority of private credit exposure, ABF is attracting more attention and could eventually surpass traditional lending in scale.

Corporate lending AUM will exceed US$2 trillion in 2026 and approach US$4 trillion by 2030. Yet, returns in direct lending have compressed as competition from the broadly syndicated loan ( BSL ) market has intensified.

And, with borrowing costs stabilizing after a period of steep rate hikes, borrowers are increasingly turning back to BSLs in search of cheaper funding, placing additional pressure on private credit yields.

ABF is now the next driver of private credit growth as non-bank lenders step in to address financing gaps left by constrained banks. As well, alternative asset managers are targeting consumer and digital infrastructure assets, leveraging structured solutions to expand origination pipelines.

The capital requirements of the global digital economy are immense with rapid growth in cloud capacity, artificial intelligence data processing and broadband connectivity creating sustained demand for financing well beyond the capabilities of traditional bank balance sheets.

Data centre securitizations, according to Moody’s, have surged in response. In 2025, issuance of data centre asset-backed securities ( ABS ) and commercial mortgage-backed securities increased by 80% from the previous year, driven by the refinancing of construction loans and approaching term-note maturities.

Private equity-backed sponsors led a majority of these transactions. Similarly, rising demand for high-capacity fibre networks is accelerating issuance of fibre network securitizations, Moody’s explains, while leasing and equipment ABS structures are expanding to fund capital-intensive technology hardware, such as servers, routers and graphics processing units.

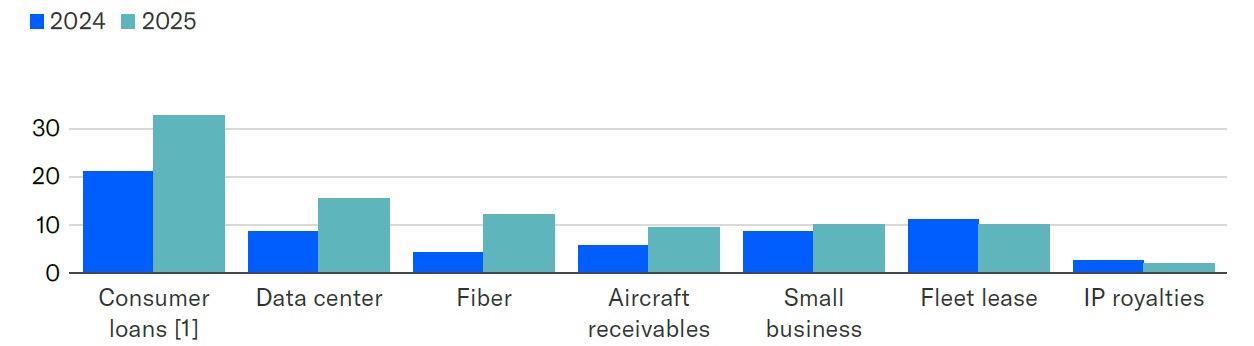

Private credit expansion into consumer ABS will continue ( in US$ billion )

[ 1 ] Includes marketplace and home improvement

Source: Moody’s Ratings

This expansion is particularly pronounced in Asia-Pacific, where private credit markets are deepening rapidly. In January 2026, KKR, for example, completed a US$2.5 billion fundraising for privately originated performing credit investments across the region, including US$1.8 billion in its KKR Asia Credit Opportunities Fund II and US$700 million through separately managed accounts.

This follows the firm’s US$1.1 billion inaugural Asia Credit Opportunities Fund closed in 2022. KKR’s initiatives illustrate how global alternative managers are scaling up to meet Asia-Pacific’s growing credit needs, particularly in sectors tied to digital transformation and infrastructure development.

Investor sentiment remains resilient, albeit with a more selective approach. In the next 12 months, 42% of limited partners ( LPs ), reveals UK-based investment firm Coller Capital, expect to increase allocations to private credit – more than for any other alternative asset class. Yet, nearly two-thirds of LPs ( 62% ) foresee wider dispersion in returns among private credit managers, indicating performance differences will grow as competition intensifies. This expectation is most pronounced in Asia-Pacific, where 73% of LPs anticipate greater variation in manager outcomes.

Private credit continues to evolve through financial innovation as fund managers adopt structured credit, rated fund vehicles, net-asset-value lending and payment-in-kind loans to create greater liquidity and customization. As well, the growing implementation of evergreen fund models signals a shift in how managers distribute and manage capital, broadening access for institutional and private investors alike, according to Coller Capital.